ECON 140W - Week 3

Class 5 - Jan. 20, 2026

Terminology

-

Numbers in brackets are for 15+ in Canada in December

-

Employed (21,056,400)

- Includes people on leave (employed but zero hours worked)

-

Unemployed (1,413,200)

-

Not in the labour force (12,253,300)

-

if you add 21,056,400 and 12,253,300, you get less than the population of Canada

- Why? We don't count people under 15 years old

-

Participation Rate (or activity rate)

- (Employed + Unemployed)

Total population

- (Employed + Unemployed)

-

Employment rate

- Employed

Total Population - Telling us about the long-run trend of environment

- Employed

-

Unemployment Rate

- Unemployed

Labour Force - Unemp

(Unemp + Emp) - If unemployment rate right now is 6%, that doesn't mean employment rate is 94%

- Unemployed

Seasonal Adjustments

- Measured unemployment rate in Canada went from 8.0% in August to 6.3% in December

- Commonly reported unemployment rate in Canada went from 7.1% in August to 6.8% in December

- Reported unemployment rates are adjusted for seasonality

- Unemployment rates always high in January, July, August due to hiring processess

- Unemployment rates always low in April, May, December

- Adjust reported rates for these differences when comparing within a year

Dynamics of the Labour Market

- Labour market flows

- People move between states (employed, unemployed, out of labour face)

- Changes in the unemployment rate can reflect variety of changes

- In recessions, some people may stop looking for jobs, so unemployment rate doesn't rise that much and in fact may go down

- Long-term unemployment is a significant problem

Other Employment Terminology

- R1 - 0.8% - is the fraction of the labour force who've been unemployed for longer than a year

- R2 - 2.7% - is the fraction of the labour force who've been unemployed for longer than 3 months

- R3 - compared to US rate (5.3%)

- Always higher than US because

- US starts counting at 16

- Main reason: The question of "Are you looking for work?" differs. In the US you have to apply for a job or go to a government employment center. Compared to Canada where you can say you scrolled on indeed and didn't find any job

- US has high prison population

- Always higher than US because

- R4 - Unemployment (6.3%) - official measure (not seasonally adjusted)

- R5 - Discouraged (0.2%) - available but not looking

- R6 - Waiting (0.5%) - Not working, but waiting for a job to start/restart

- If someone hires you in April but you don't start till August for example

- R7 - Involuntarily Part-Time (1.5%) - in full-time equivalents

- Would like to work more, available for more hours, but can't

- R8 - Include R5, R6, R7 (8.5%)

Types of Unemployment

- Frictional unemployment

- matching employers to employees takes time

- Always positive

- Structural unemployment - usually 2.5-3%

- Wages held above market clearing level

- Always positive

- Long-run unemployment is equal to frictional plus structural (estimates between 5.0% and 6.5%)

- Cyclical unemployment is the variation over the business cycle - usually 2-3% because of people moving between jobs

Frictional Unemployment

- Job search takes time

- Finding a good match, going through an application and interview process, etc.

- While this happens - people are enemployed

- Policies that impact frictional unemployment

- Employment insurance

- If you're getting good benefits, you're less likely to take a job - causes increase in frictional unemployment

- Job search, job training

- Since you get employment insurance, there will be better job matching because people will spend more time looking at the best position for them

- Employment insurance

Structural Unemployment

- When wages are higher than the equilibrium level

- Efficiency wages

- Paying a higher wage to make you more efficienct, so they higher a bit less

- Employers will often pay more than they absolutely have to because they don't want you to just leave

- Unions

- Job protection regulations

- Minimum wage laws

- Efficiency wages

Economic Costs of Unemployment

- Costs of unemployment depend on economic conditions

- Quality of job matches varies after unemployment

- Depends on unemployment rate

- Unemployment can lead to hysteresis

- Once unemployed, skills erode making it harder to find work

- A period of unemployment can lead to a higher equilibrium unemployment rate

- Long-term unemployment has longer-term consequences

- Government gave certain companies money to keep paying people to not work so that people don't just leave the industry with these specialized skills

Artificial Intelligence and Unemployment

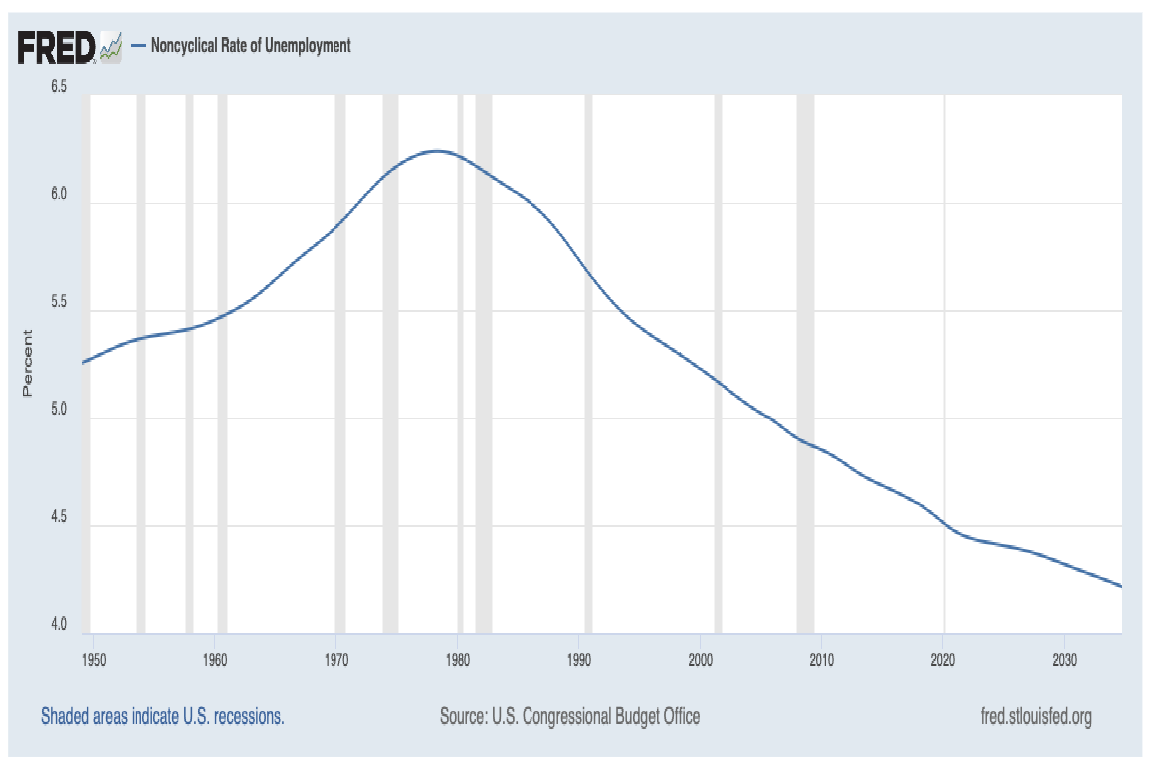

- Equilibrium (non-cyclical) unemployment also falling in the U.S.

- People talk about AI replacing jobs

- If you're automating something, somebody's job gets lost but another one is created

- There is not a fixed amount of jobs

- Not clear this is happening yet

Productivity

- What about wages?

- Labour productivity commonly measured as output per worker or ouput per hour worked

- Not the same as wages, but related

- From 1997 to 2025

- Average hourly wages increased from $15.59 to $36.40 (not adjusted for inflation)

- Average weekly wages increased from $573.50 to $1329.77

Class 6 - Jan. 22, 2026

- From province to province, participation rates and employment rates vary significantly!

Measuring Inflation

- Can be super easy and also super hard

- Identify a basket of goods people are going to buy

- How much will that cost?

- Measure it each year, and then another year, and then you find inflation

- Includes food, housing, electronics, rent, etc. basically everything that Canadians buy

- They track million of things people buy and measure the cost of the basket of all of it

- Must choose a base year (always 100), and you measure the prince index relative to the base year

- Currently, it's 2002

- Issues?

- We need to account for the change in quality for goods

- What exactly is in the basket of goods?

- For example, streaming services did not exist back then, it was really just cable

- How often do we change the goods that we're looking at?

- They use some chain-related thingy to adjust it but nobody ever does it unless you work for Statistics Canada

Measures of Inflation

- We measure multiple different types of inflation

- All-items CPI - reflects average purchases in Canada (literally everything we buy)

- Core inflation - throw out all the food and energy purchases - natural gas, food, energy

- We do this because the prices fluctuate a lot that is not due to the Canadian economy

- CPI-Median - tracks the 50th percentile of price changes

- Producer price index (PPI) - business inputs

- Raw materials

- This is a leading indicator of inflation (if these rise, they'll eventually raise prices)

- GDP deflator - prices of goods that Canada produces

- GDP deflator = (Nominal GDP

Real GDP) - Any good that we import and don't produce will affect the CPI but not GDP deflator

- Example: bananas, coffee, oranges, all kinds of food, semi conductors, sugar

- We produce more than we consume of: oil, wheat, lumber

- GDP deflator = (Nominal GDP

Core Inflation

- Common comparisons: CPI to GDP deflator or CPI versus Core Inflation

- Bank of Canada reports changes in core inflation

- Measure that excludes all food and energy prices

- They are highly traded commodities on the global scale

- Changes in these prices are almost entirely unrelated to Canadian economic conditions

- Bank of Canada prefers other measures (CPI-median)

- Key point - Bank of Canada using inflation measures for a specific purpose

Adjusting for Price Effects

- Use the prince index to adjust for price changes

- Nominal variables

- Measured in current prices

- If you go back to 1997, minimum wage was ~$7, but real minimum wage would say okay how much could $7, 28 years ago, buy today

- Real variables

- Mostly talk about real GDP, real interest rates, etc.

- Real equals nominal minus inflation (approximately)

- This is precisely true for interest rates

- Real interest rate reflects the change in buying power

Example:

This is less than today's $16.70.

- There's a problem with this statement though.

- CPI tracks everything, even things that regular Canadians don't buy

- For example, a boat

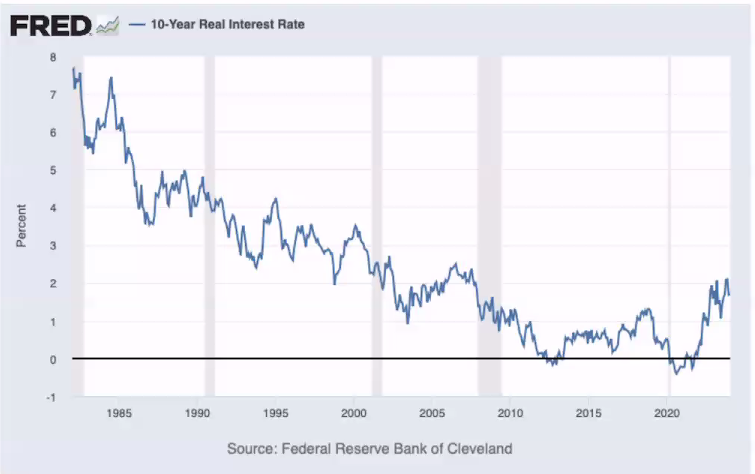

Real Interest Rates (US Data)

- Real interest rates fell since 1980

- Companies, people lend based on real interest rates, that's really all that matters

- Negative nominal interest rates are bad

- Real interest rates being negative is not necessarily bad

- Nominal interest rate minus expected inflation rates

- 7% interest implies doubling purchasing power in 10 years

- Rule of thumb (Rule of 70): $$\frac{70}{7} = 10$$

- Zero real interest rates recently

- Why have real interest rates fallen? Chapter 14 says it all

Average Wages for Youth in Canada

- Data from December 2024 to December 2025

- Inflation was 2.4%

- Youth (15-24) - average wage increase 2.3% (or -0.1% real increase)

- From $21.72 to $22.21

- Lower paid sectors (still focused on youth - 15-24)

- Wholesale and retail trade - from $18.80 to $18.54 (not good)

- Accommodation and food service - from $18.28 to $18.32

- Other sectors

- Finance, Insurance, Real Estate (FIRE) - from $25.69 to $27.74 (+8.0% nominal, +5.6% real)

- Not a huge group of people so varies often

- Finance, Insurance, Real Estate (FIRE) - from $25.69 to $27.74 (+8.0% nominal, +5.6% real)

Money Illusion and Nominal Wage Rigidity

- Money illusion

- Focusing on changes in nominal dollar amounts

- People get mad when they're nominal dollars go down

- Nominal wage rigidity

- People focus on nominal wages - no one likes a pay cut

- When cutting payroll costs, companies choose layoffs over pay cuts

- In recessions, unemployment rises instead of wages falling

- A key reason to target positive inflation (2%)

What is Money?

- Medium of exchange

- Can you buy things with it?

- Unit of account

- Do you record prices in that value?

- Do accountants record balance sheets and income statements

- Store of value

- Can you keep value in that product?

- Can you reliably keep assets in that value and know what they will purchase

- Is gold money? Is Bitcoin?

- BITCOIN IS NOT A UNIT OF ACCOUNT

- IT'S NOT A MEDIUM OF EXCHANGE

- The fact you can buy some things with it, doesn't mean it's a median exchange

- In Nicaragua, they made bitcoin an official currency

- This doesn't mean it's money though. In order to be considered money, it has to be generally accepted almost everywhere

- Is the US dollar money in Canada?

- It's a decent medium of exchange, almost everybody accepts it!

- Most grocery stores will accept it

- It's not really a unit of account though

Expected vs. Unexpected Inflation

- What was expected inflation in 2025? What was inflation in 2025?

- If there's unexpected inflation, that throws prices out of whack quickly!

- What inflation rate should you expect in 2026?

Costs of Inflation

- With expected inflation,

- "Menu" costs is more generally the decision process on what should we charge, "shoe-leather" costs

- With unexpected inflation,

- Prices convey less information, redistribution (lenders vs. borrowers)

- If you're gonna get $20/hour but don't know how much things will cost, you don't know what you can get

- Inflation is good for students that owe money on student loans

- If inflation happens during university, this is good because wages will then go up later

- Prices convey less information, redistribution (lenders vs. borrowers)