ECON 140W - Week 1

Class 1 - Jan. 6, 2026

What is Economics?

- Inflation

- We want this to go back to being boring

- GDP

- Measure of output in the economy, why it's good, why it's not great for everything

- Unemployment

- Technically, can't be unemployed as a student

- Monetary policy

- We should have enough knowledge by the end of the course to write our own monetary report like the Government of Canada does

- Fiscal policy

- Taxes

- Spending

- What is the problem with government debt? Issues/benefits or running a deficit

- Investment

- Building up a physical investment like a factory

- Financial investments like bonds, stocks, international foreign currency exchange

Long-Run Trends and Fluctuations

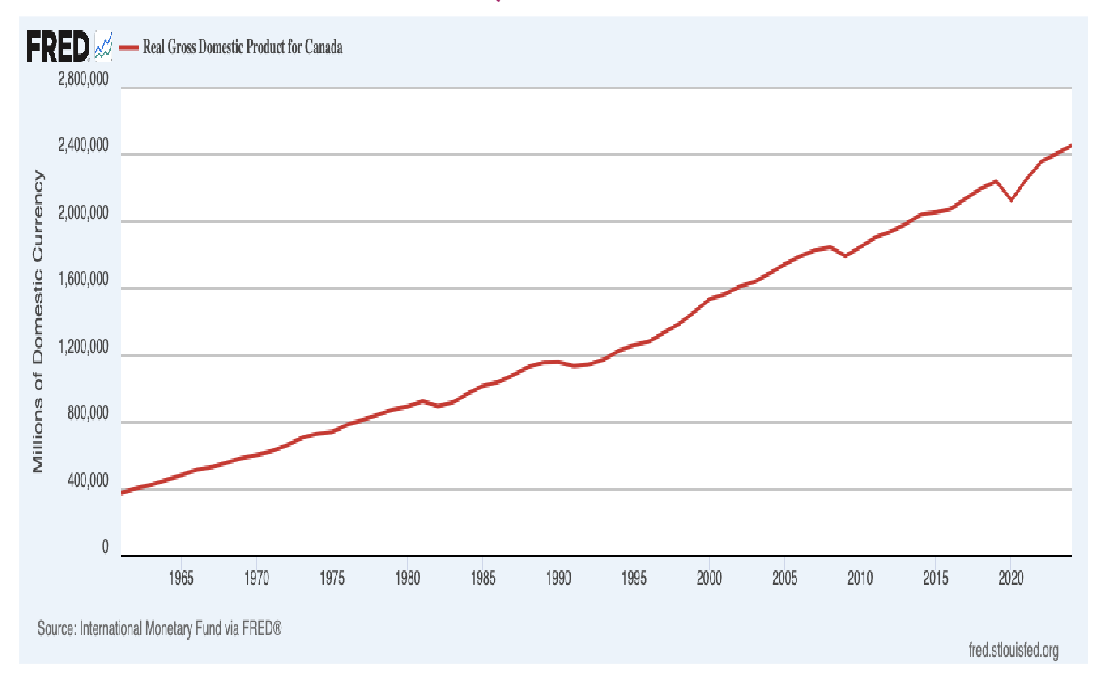

Total GDP, Canada

Recession dates: 1982, 1991, 2008, 2020

Reasons for growth:

- Partly because we're better at producing stuff

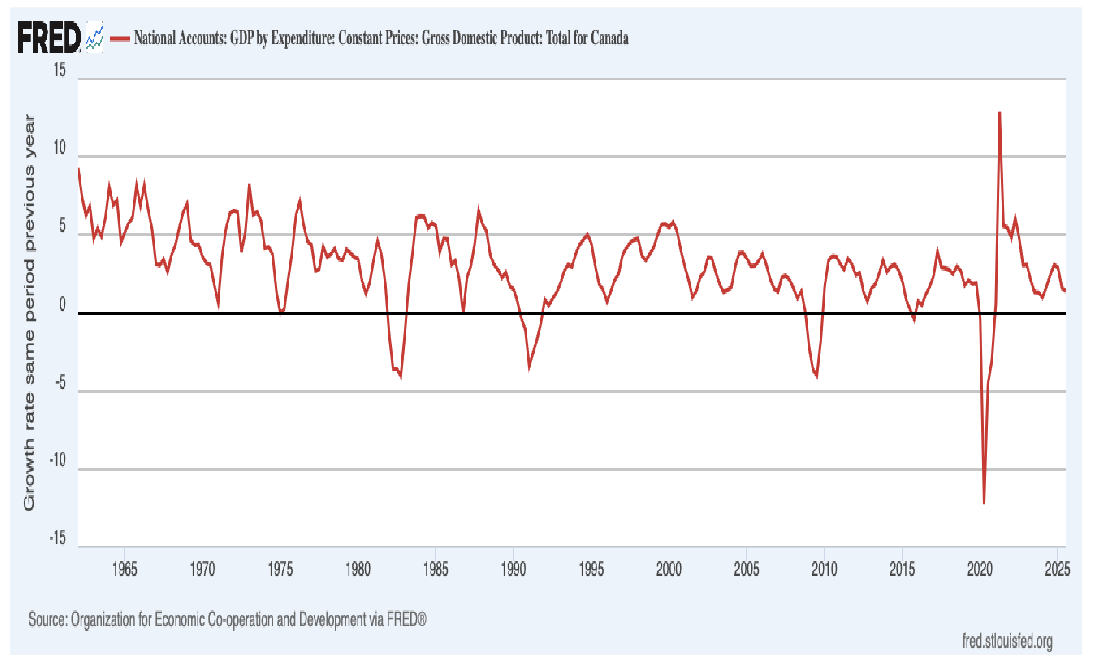

Growth rate, GDP, Canada

Reasons for growth:

- When growth rate negative, recession! woohooo

Policy Issues

- Fiscal policy

- Tax rates, government spending, trade policy

- Monetary policy

- Interest rates, currency regimes, international finance

- Most policy choices involve tradeoffs

- Lenders vs. borrowers

- If interest rates go up, as a lender you make more but borrowers you lose more

- Homeowners vs. renters

- When housing prices go up, theof Canadians that own houses are happy

- This is a reason students have a hard time in EC 140, because there's not much intuition that can be used - Short-term - Unemployment vs. inflation (maybe?)

- If Bank of Canada lowers interest rates which causes more unemployment

- Long-term - Growth vs. Inequality (maybe?)

- Lenders vs. borrowers

Choices Among Alternatives

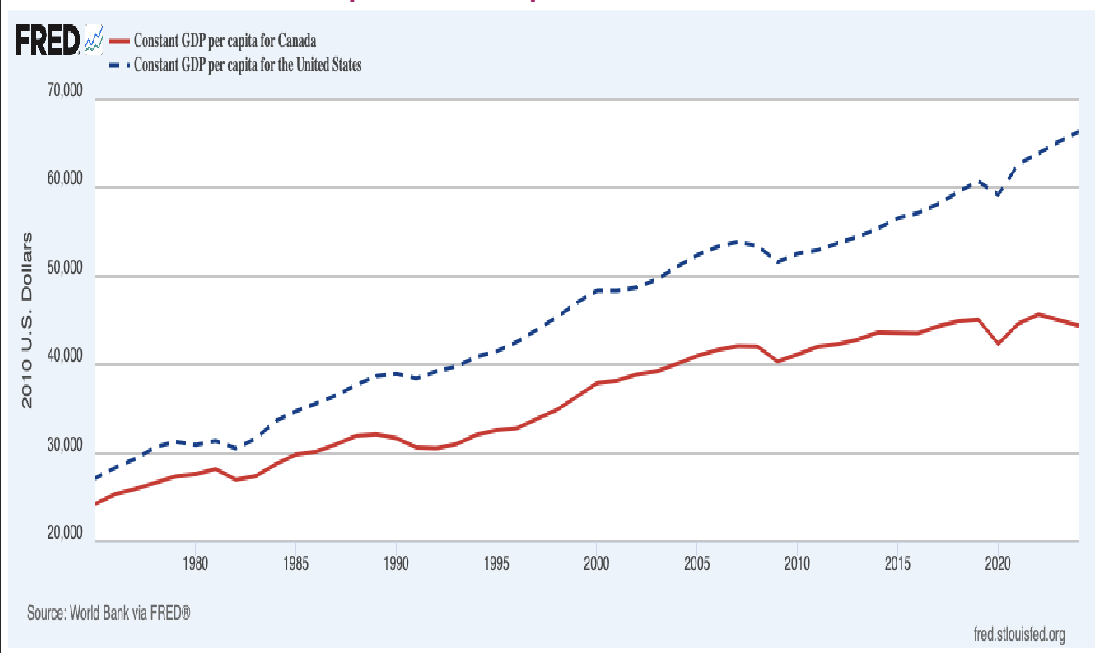

GNI per capita, 2010 USD

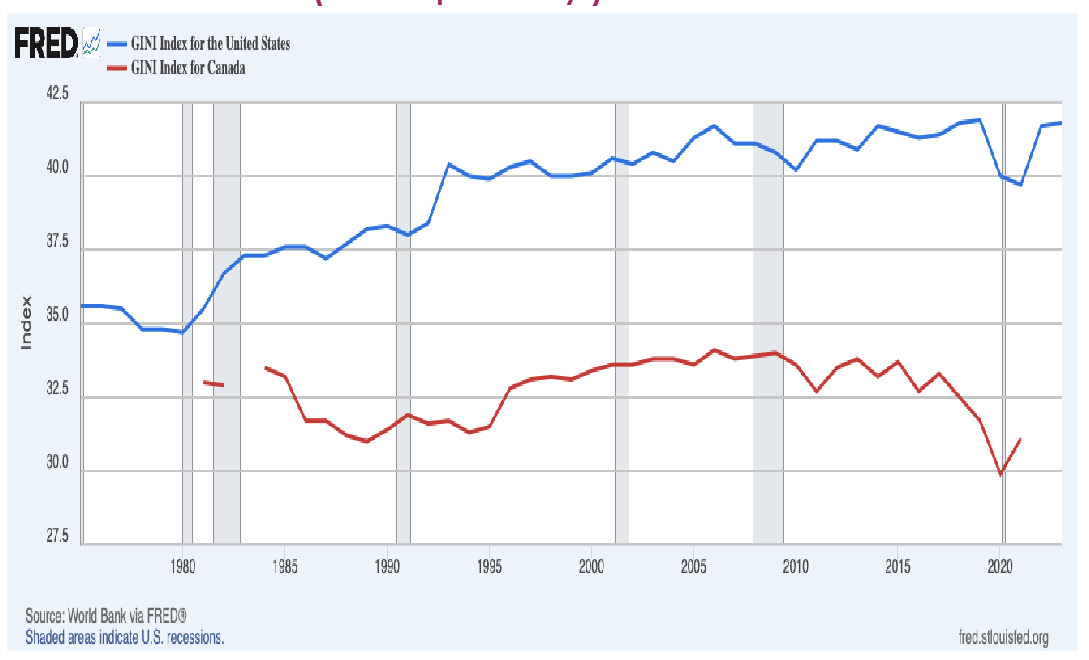

Gini index (inequality)

This ^ is bad, because people in Canada will want to go to USA because they can make more.

Time Horizon and Economic Policy

- What are the key policy issues over:

- The next 4 months - by the end of the term

- Not much will change

- Monetary policy and economic management

- The next 4 years - during your degree

- Fiscal policy, government debt and deficits, housing prices

- Government invests a lot in education

- The next 40 years or longer

- Economics growth, productivity, and the future of work

- The next 4 months - by the end of the term

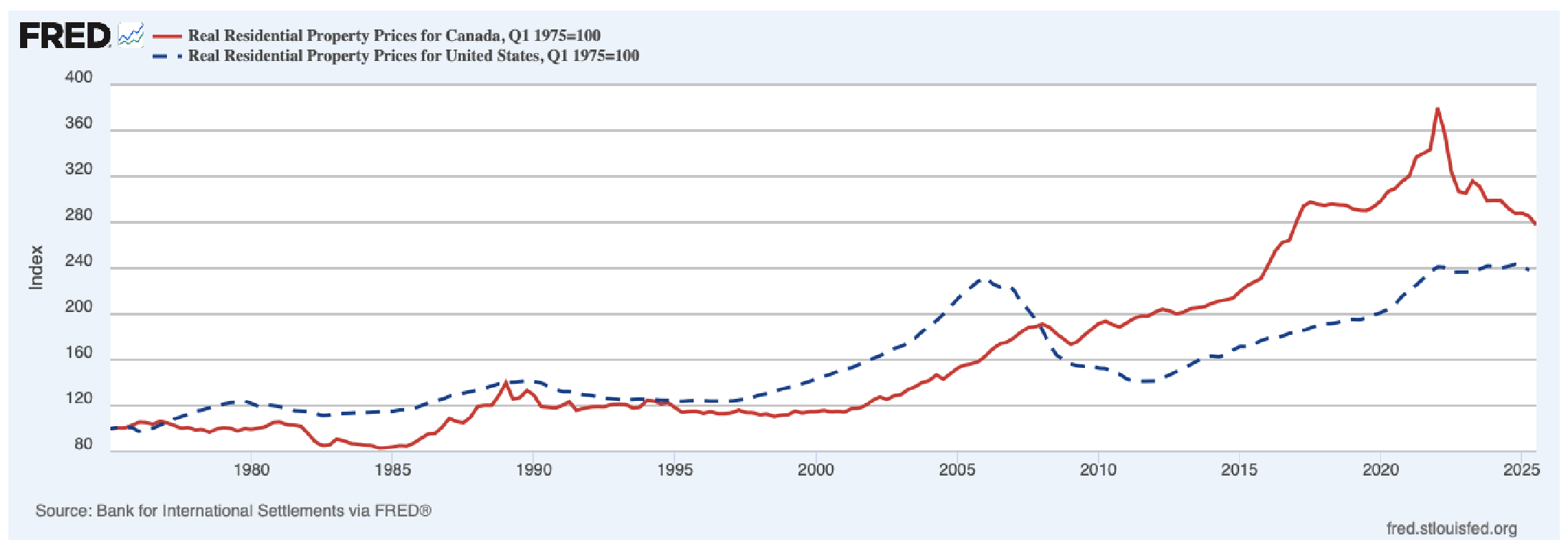

Critical Questions - Housing Market

2008 Financial crisis: Went down by half - led to global recession

- In the past 3 years, housing prices have decreased in Canada but not a global recession because Canada is small

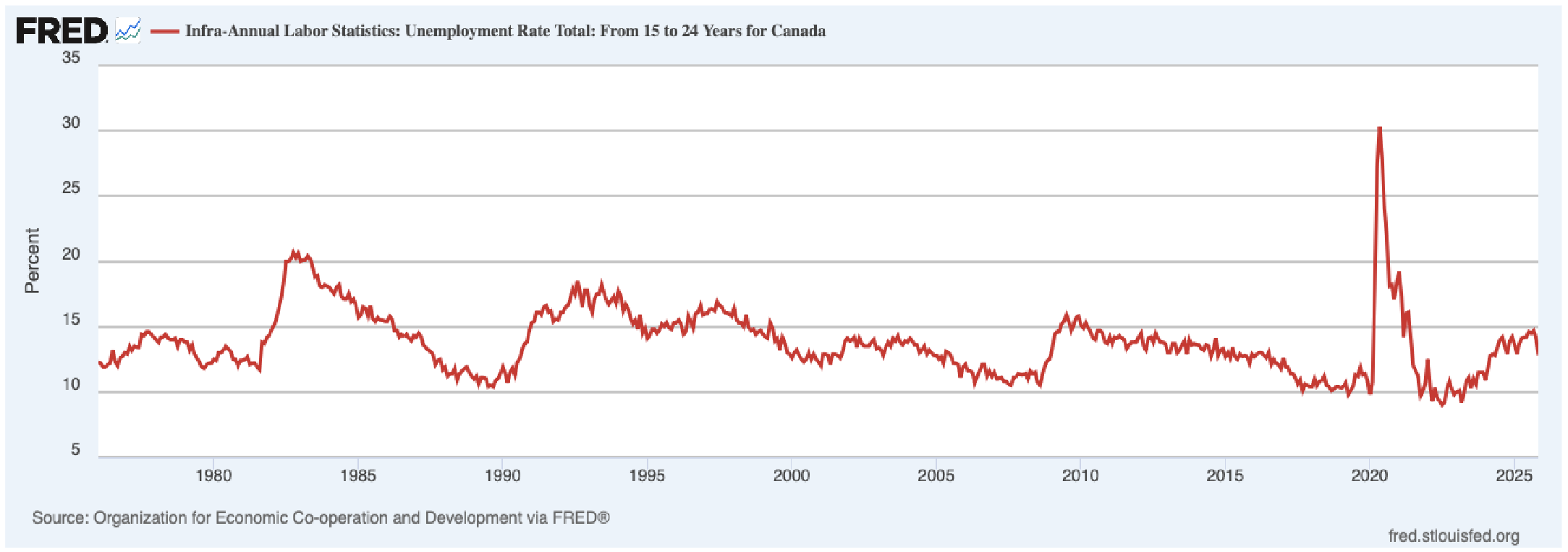

Critical Questions - Youth Unemployment

Has fluctuated around but in October/November has dropped. We're at 15% right now. We have long term decline in unemployment rates with short term inclines.

Sources

- Macroeconomics is about the link between theory and data

- Key data sources in this course:

- Statistics Canada (https://statcan.gc.ca)

- Daily releases of new information

- U.S. Federal Reserve (https://fred.stlouisfed.org)

- World Bank (https://data.worldbank.org)

- Statistics Canada (https://statcan.gc.ca)

- We aren't expected to memorize data, but one of Ken's goals is that we occasionally check to see if our assumptions are correct

Class 2 - Jan. 8, 2026

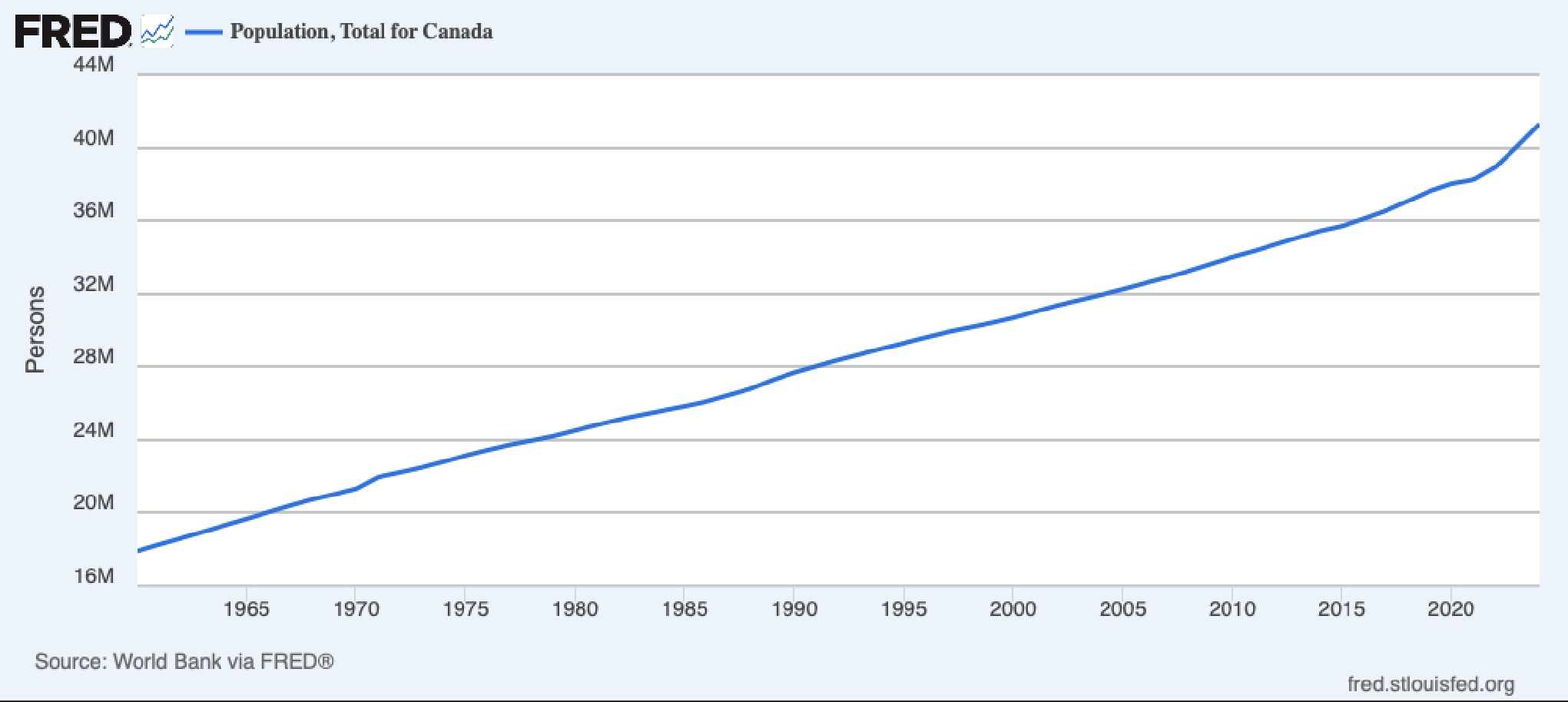

Population in Canada

Ken thinks Macroeconomics starts in Canada

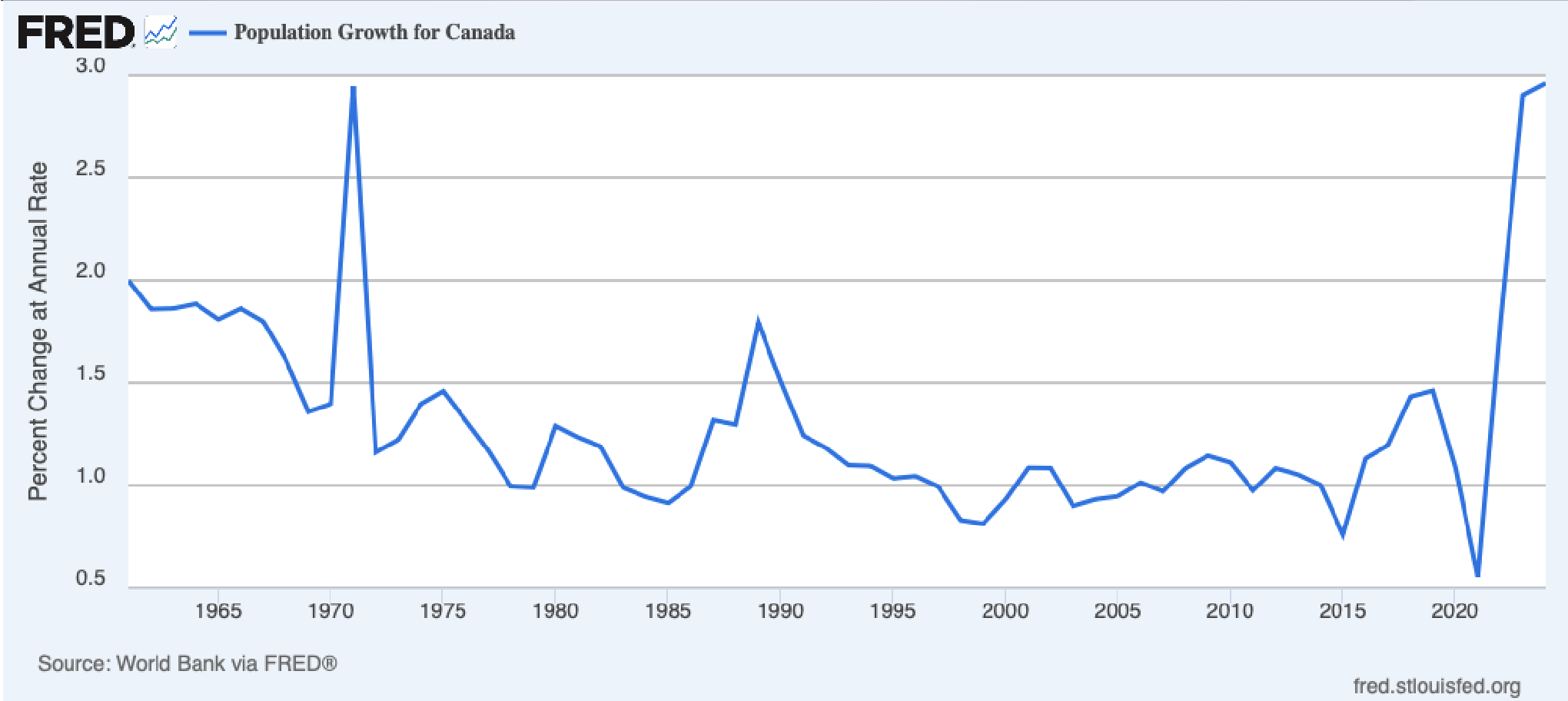

Population Growth in Canada

Canada does a bad job at tracking population. Canada doesn't know when you left the country.

The spike in 1971 is because they realized that they miscounted really badly.

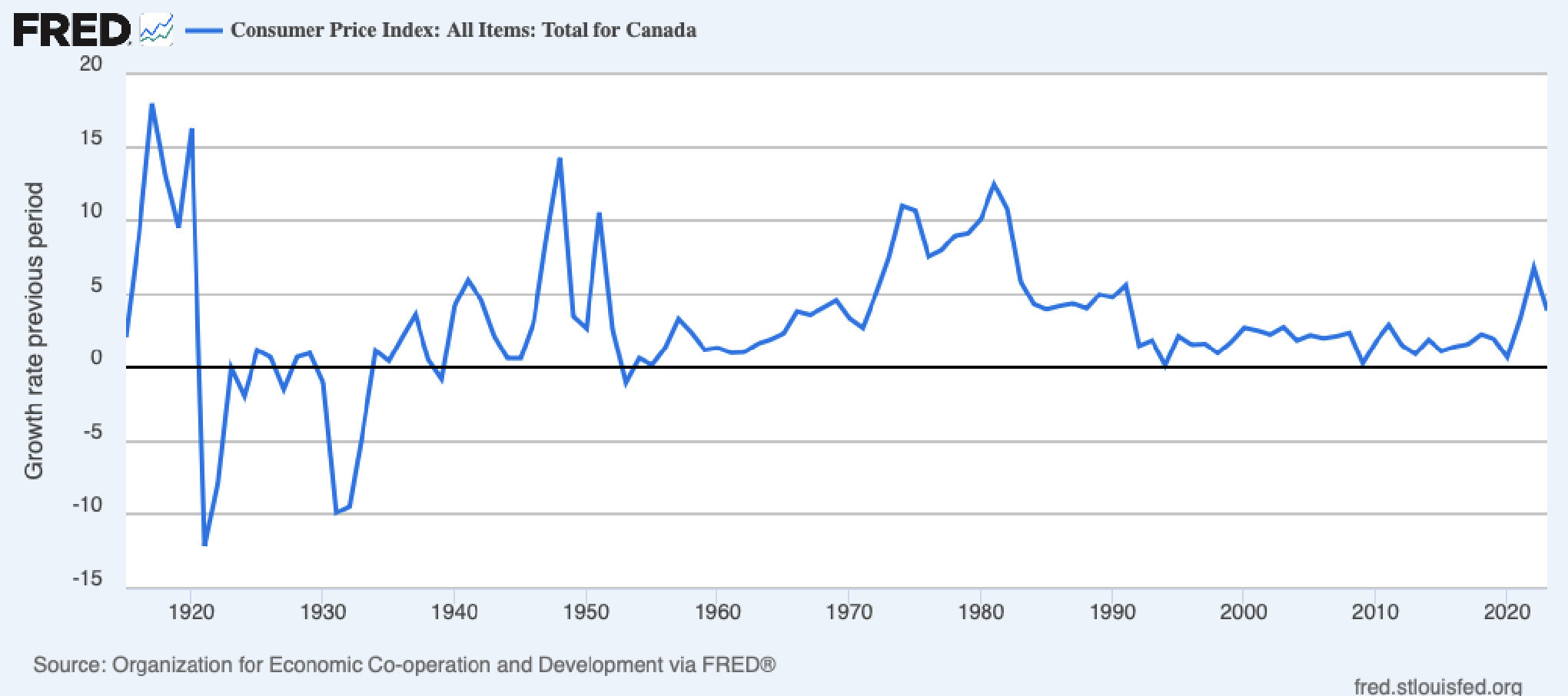

Canada Inflation Rate - 1915-2023

- During the first world war, Canada started measuring things quite a bit. This is because during wartime, economics goes wild.

- Negative inflation is almost never good. (Post WWI and The Great Depression above).

- Ken won't spend much time talking about pre-1950 when it comes to data because it wasn't amazing and there was 2 world wars, etc.

- There's a big boost in oil control during the 1970s leading to US going off the gold standard and thus high inflation.

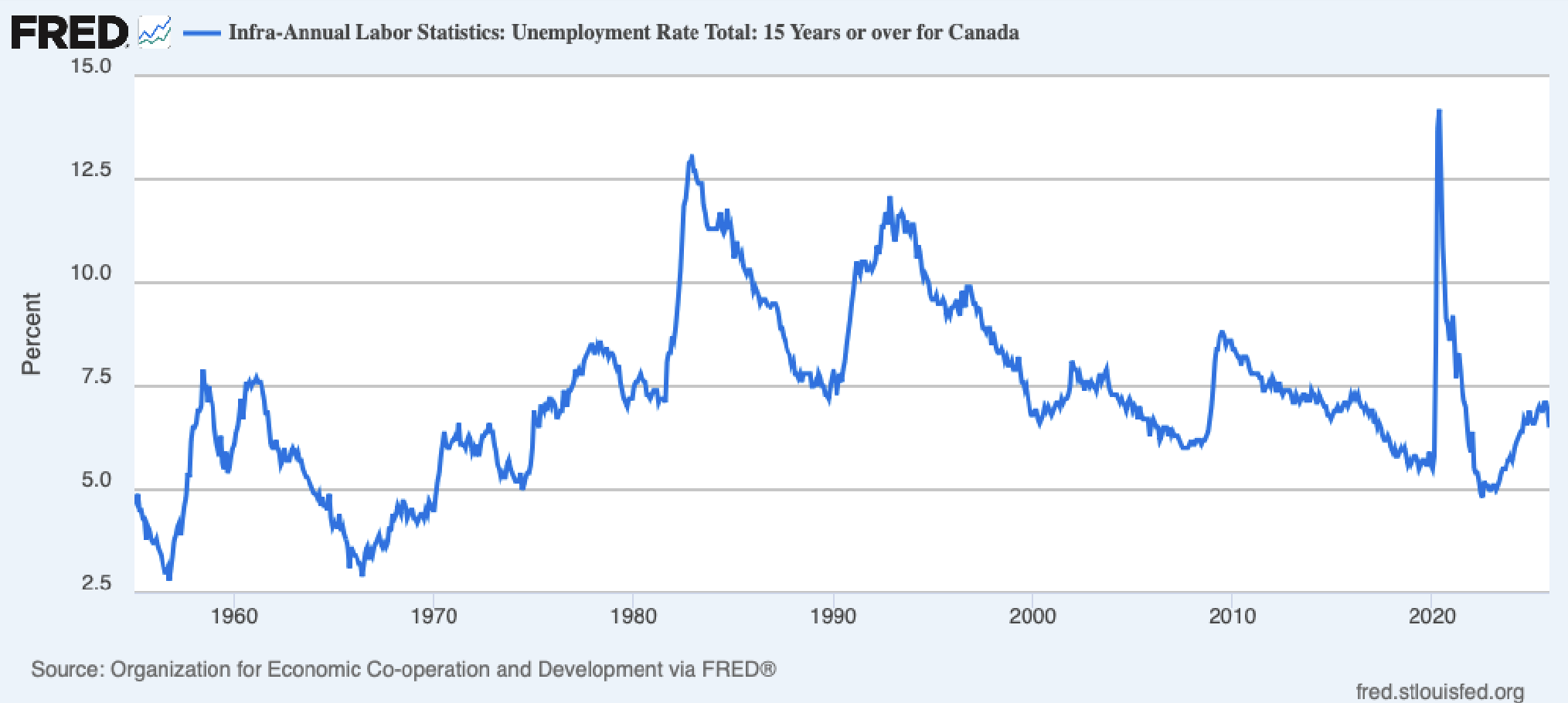

Canadian - Unemployment

- Statistics runs a labour survey - they survey 60,000 people and ask them if they are employed and a bunch of questions.

- Unemployment is the fraction of people who want a job and can't have one.

- Global financial crisis didn't directly hit Canada

- Hit finance industry but they don't really lose their jobs

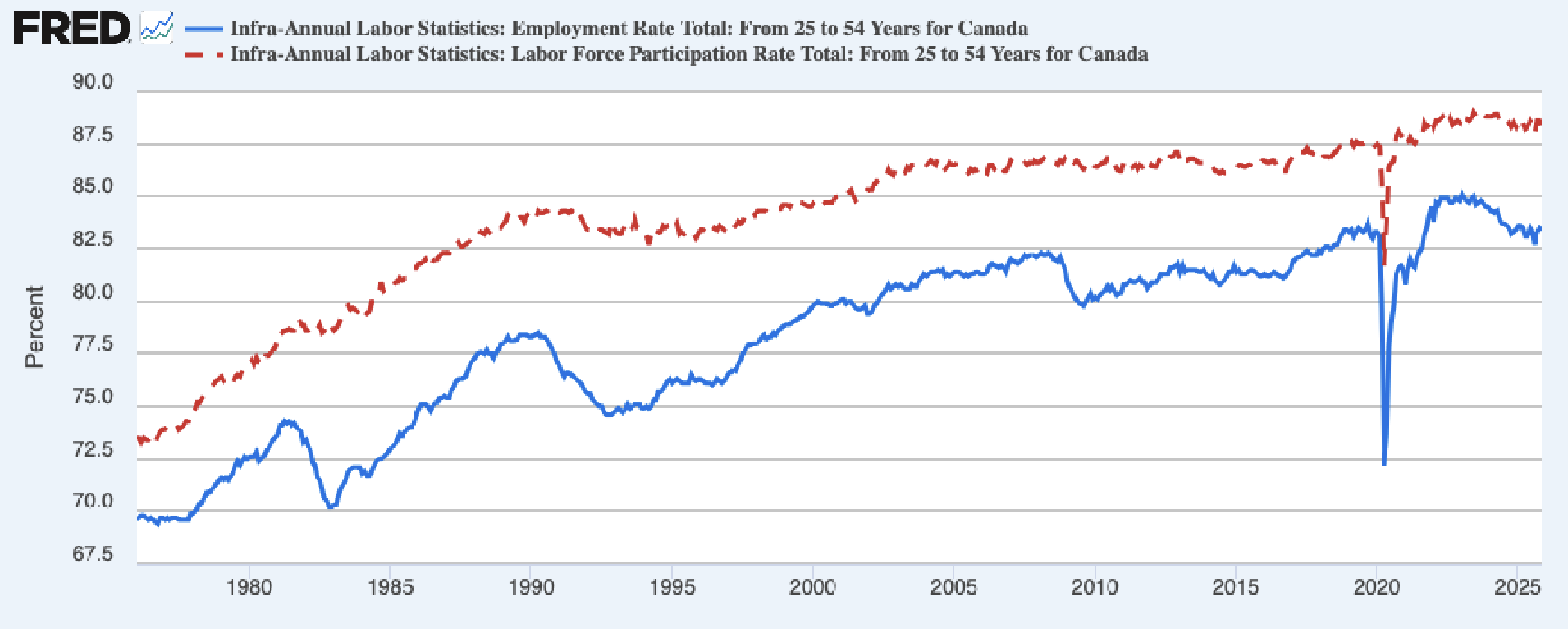

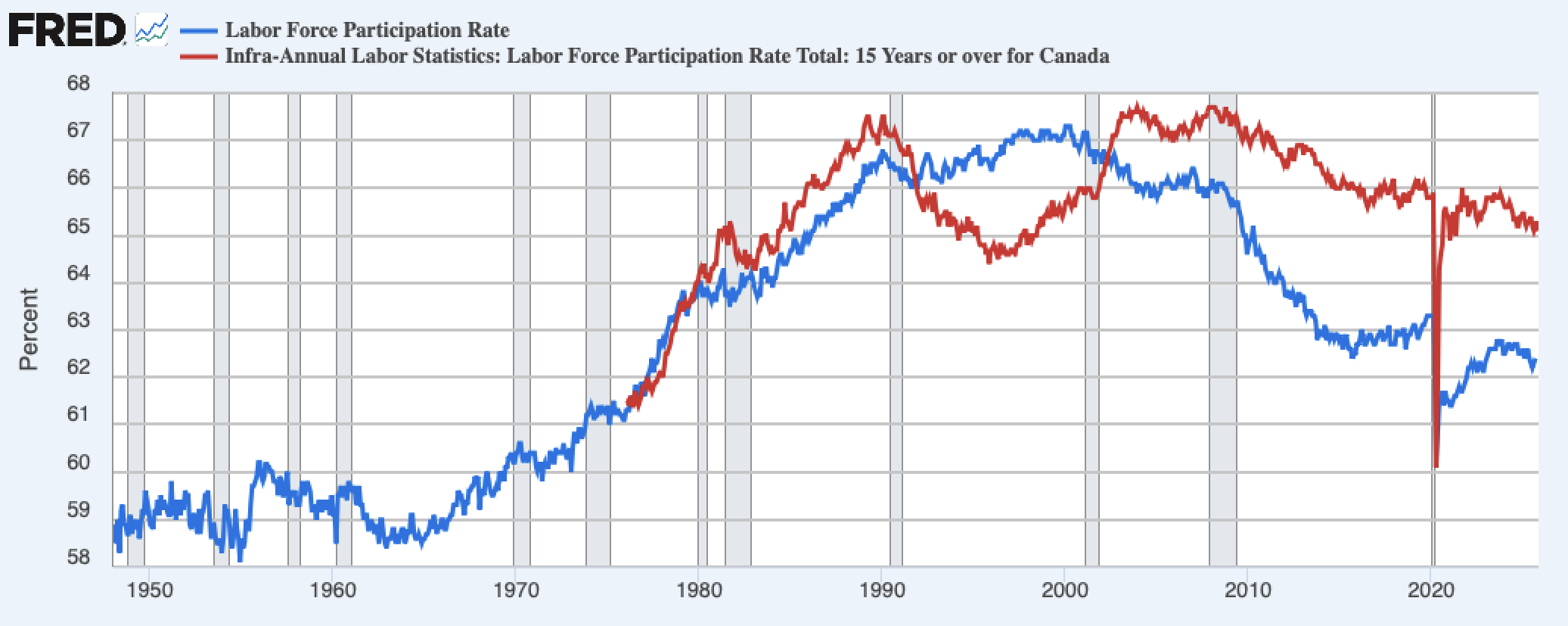

Core Age Employment and Participation

- The difference between red and blue are loosely unemployment rate.

- Rise up until 1990 is woman entering the workforce

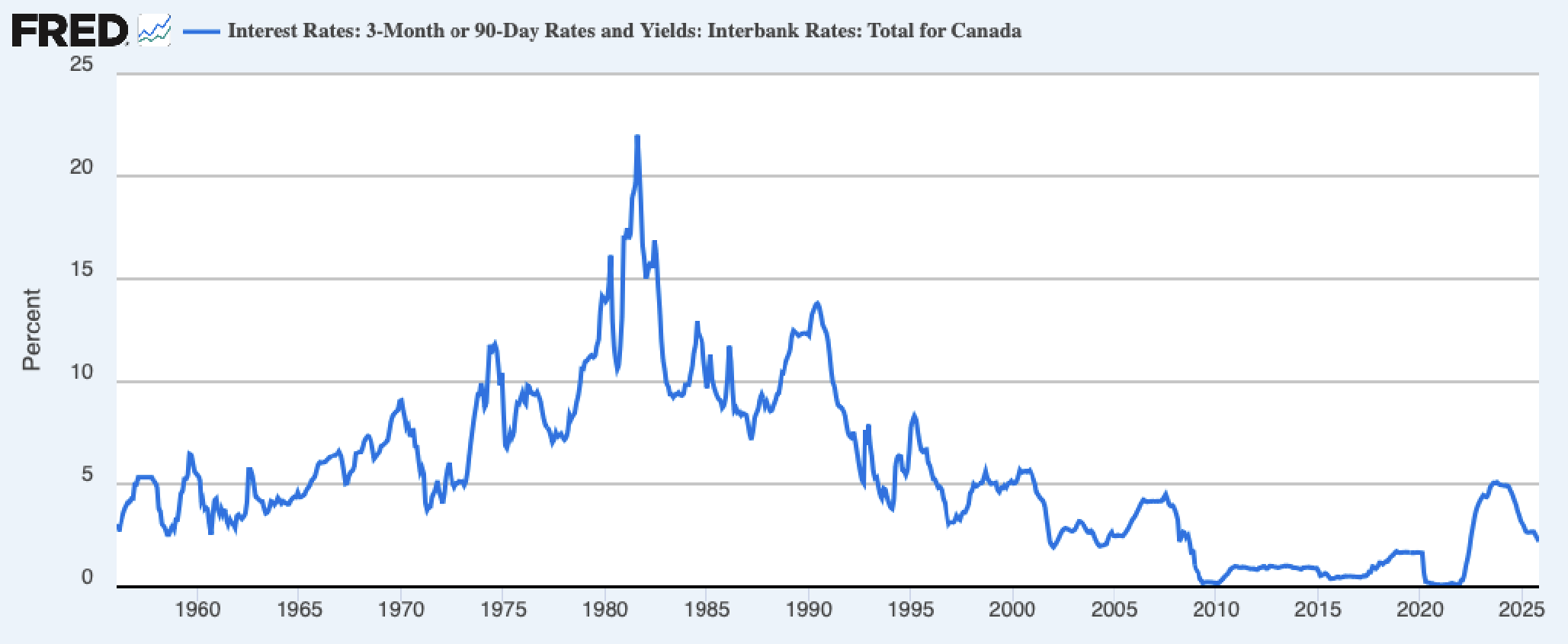

Canadian Interest rates

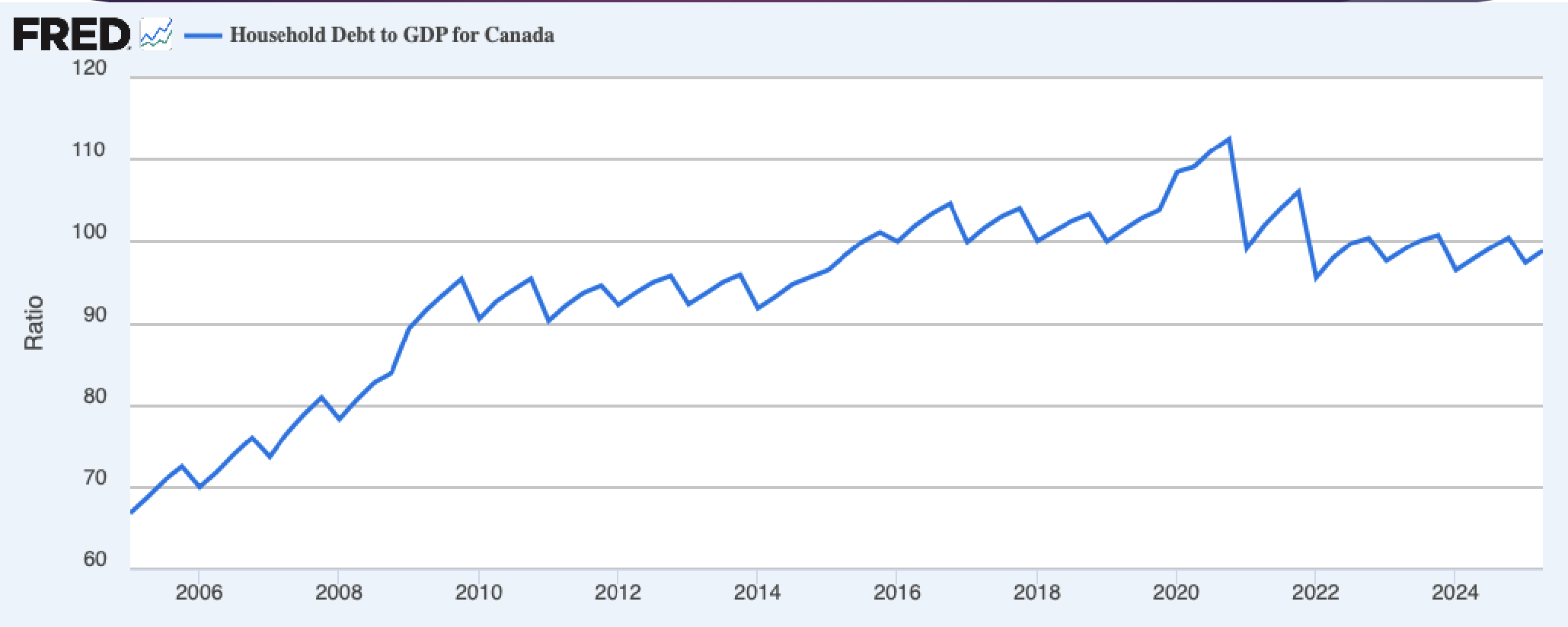

When there is really low interest rates, people borrow money:

Household Debt

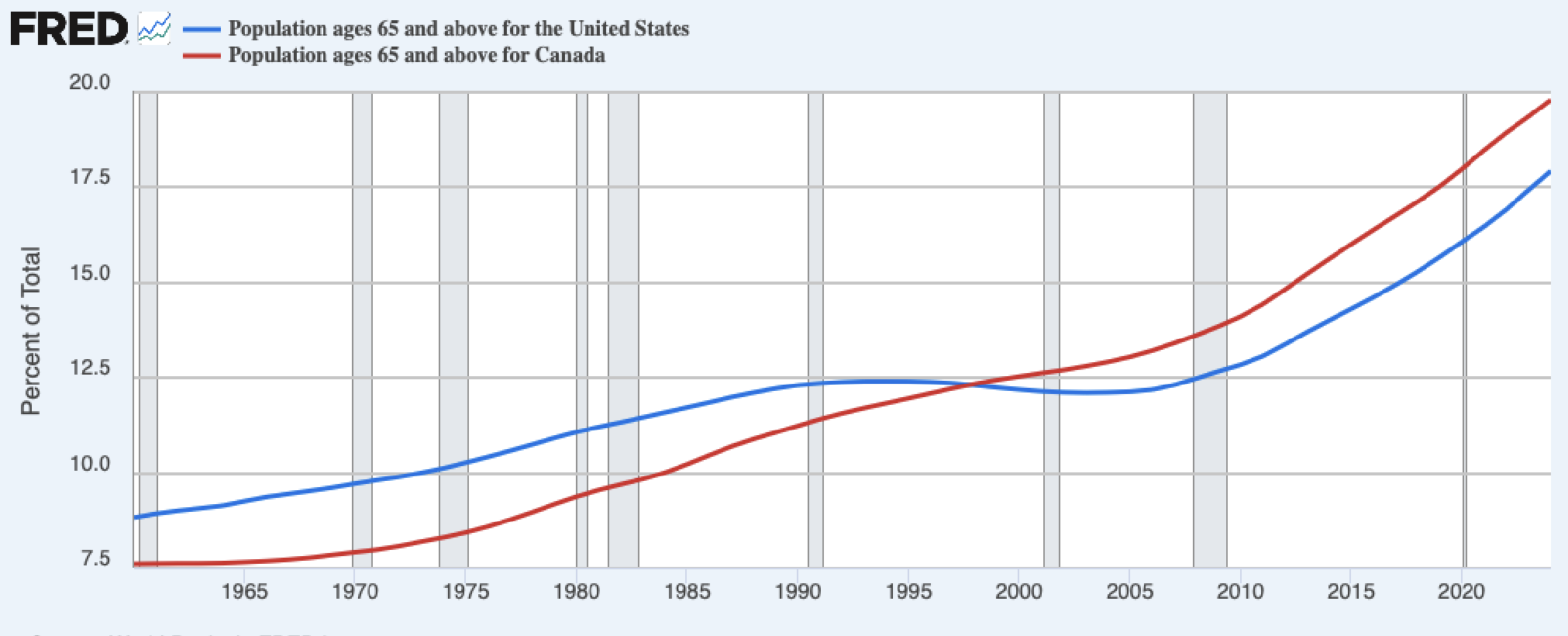

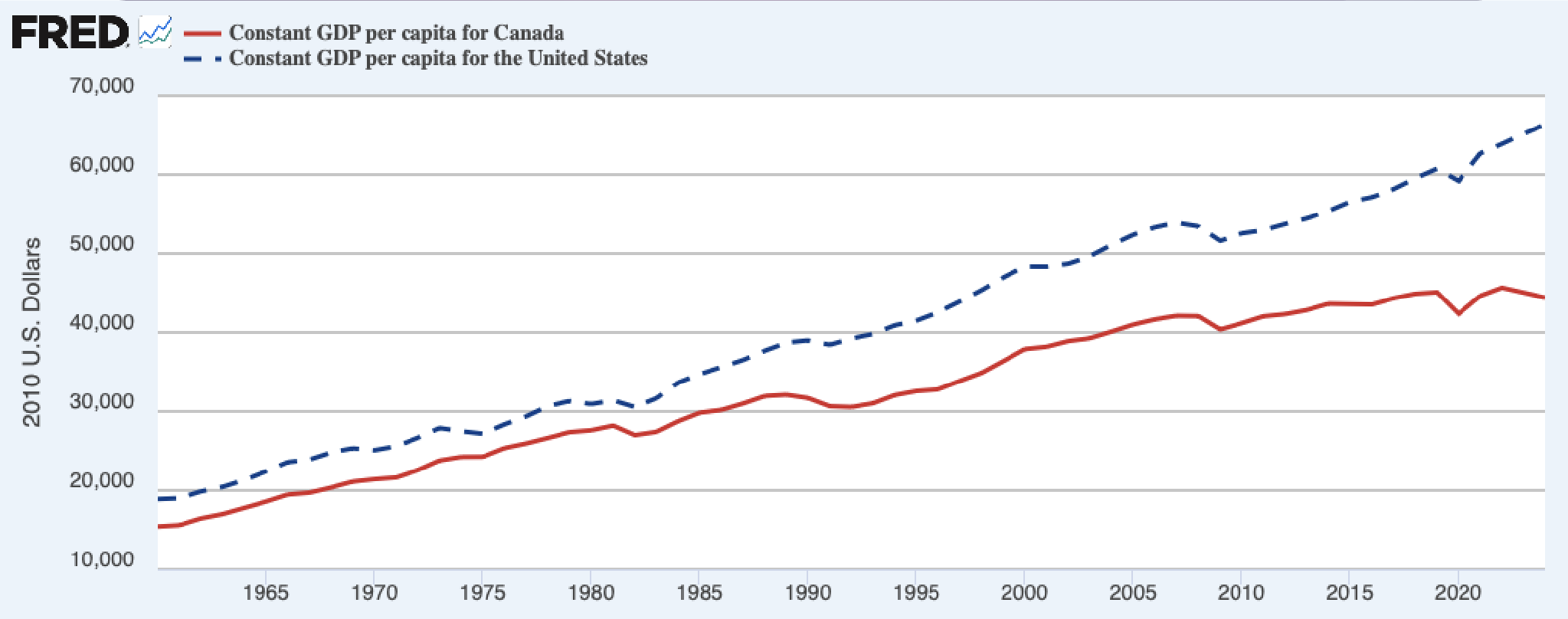

Canada in Comparison with the U.S.

- U.S. is decent comparison but not the only one

- Canada is strongly affected by the United States

- It also never serves as a natural comparison

- We should also look at other countries

- Common error to act like U.S. is the only Alternatives

GDP per capita - Canada vs. the U.S.

Canada vs. the U.S. - Labour Force

- In 1990s, the dip is due to many factors

- The steady decline since 2010s is baby boomers retiring

The Aging Population