Chapter 10 - Notes

10.1 - Economic Growth Facts

Since 1 Million B.C.

- There are very little clues or records

- People lived hand-to-mouth

- Around 12,000 years ago, people began farming

- Agricultural advances meant more food and less hunger

- At one point, everyone was basically a farmer and responsible for getting their food but by 1850, less than 25% of the British workforce worked in agriculture

- Agricultural advances meant more food and less hunger

- Skeletal remains show severe deficiencies in vitamins and minerals, and widespread disease

- People were shorter

- Most lived in extreme poverty

- It is estimated by experts that the GDP per person was only $200 in TODAY's dollars

- Didn't change until 1200 A.D.

The Industrial Revolution created an engine of economic growth

- People had more time so inventors thrived!

- They pioneered revolutionary technologies such as steam engines, sewing machines, telephones, light bulbs

- After taking more than 600 years for GDP per person to double, it more than doubled between the early 1800s and early 1900s

- After that, worldwide GDP doubled by 1950s, and again by 1975, and again by early 2000s

Economic growth means living standards and longer lives

- Economic growth means people produce more, so people consume more

- Overall standards of life get better, it's kind of like a self-fulfilling cycle

- In 1800, there was 1 billion people, no there are 8 billion

- In 1800, the average life expectancy in every country was below 50. Now, the average person in many countries can expect to live well into their 80s

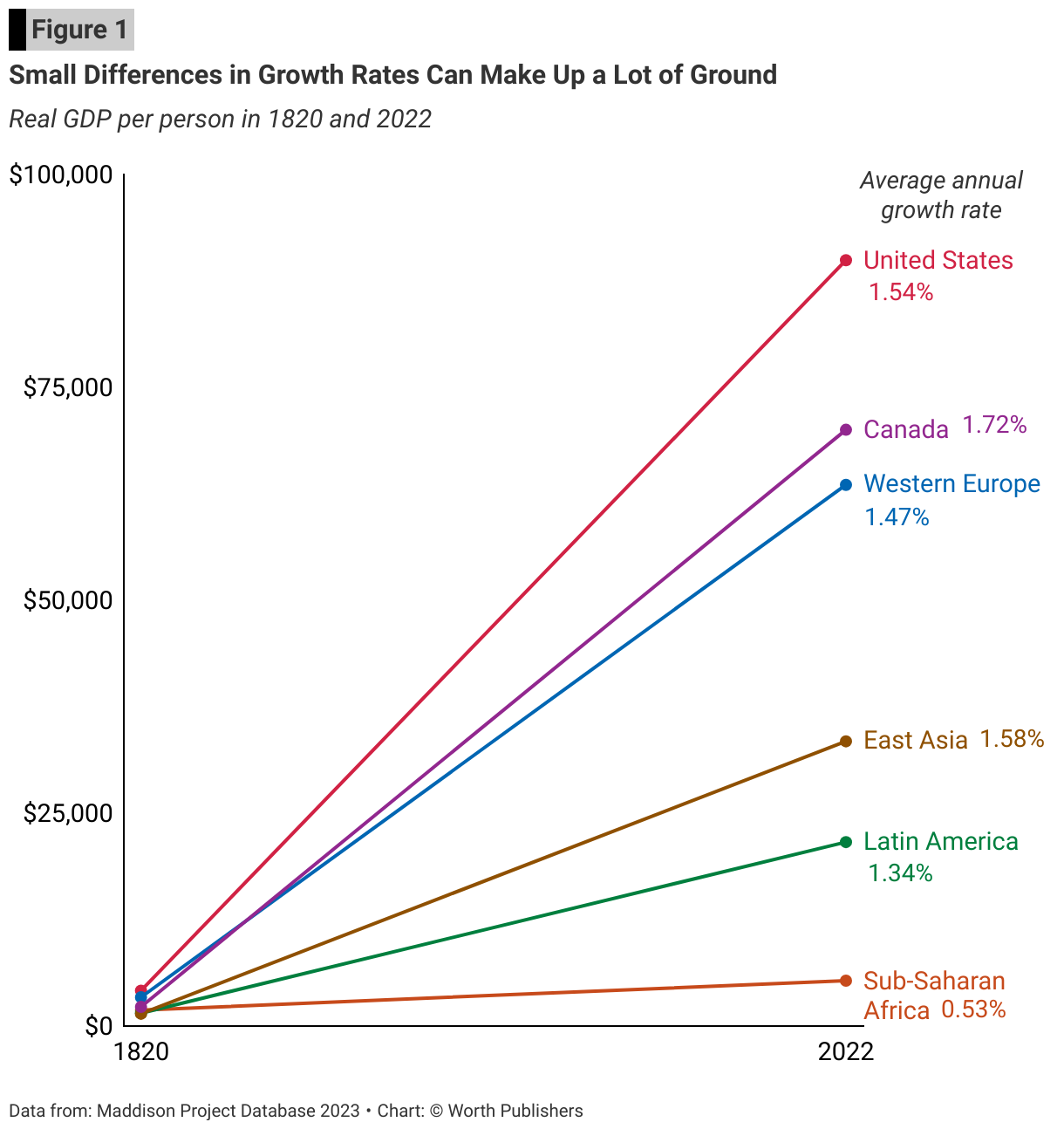

Economic Growth over the Past Two Centuries

- Certain countries GDP per person barely changed

Small differences in growth rates can have big effects

- Even the smallest difference in growth rates leads to an enormous difference over time

- In Canada, since 1820, GDP per person has grown more than 30 times

There have been growth successes and disasters

- Spain used to be a great power, but between 1600 and 1850, its economy barely grew

- Grew so slowly that by 1900, it was only roughly double what it was in the 1600s

- There's been recent rapid growth in low-income countries, helping to decrease the inequality between nations around the world

10.2 - The Ingredients of Economic Growth

What determines how much output each country produces?

The Production Function

- It describes the methods by which inputs are transformed into outputs, and determines the total production that's possible with a given set of ingredients

- It's similar to a cookbook: Example, say you bake a cake

- In this example, the production function is the whole cookbook

- A recipe would describe a particular production technique that relies on a specific quantity of milk, flour, sugar, eggs, etc.

A Production Function describes how a business transforms its inputs into outputs

- Inputs would be anything that goes into making an output

- If it's a cake shop, then inputs would be the oven, bakers, ingredients, etc.

- The production function describes how much output for any given input

The aggregate production function links GDP to labour, human capital, and physical capital

- The aggregate production function relates total output (which is GDP) to the quantity of inputs employed

- The more of each of the ingredients, the more output!

- Key ingredients are: Labour (denoted L), human capital, that describes the skills that workers bring to the job (denoted H), and physical capital, which describes the tools, machinery, and structures we work with (the letter C was taken, so following the German spelling of Kapital, is denoted K)

- It doesn't include a separate role for intermediate inputs such as the flour used for a pastry chef as they're typically produced by other businesses within the economy (we don't want to double count)

-

- Where Y is the amount of output

is a function

Ingredient One - Labour and Total Hours Worked

- The more hours you work, the more you get done

- This applies to the whole economy

- The total quantity of labour input is measured as the sum of all hours worked across the whole economy

- Reflects four factors:

- the size of the population

- Provides the upper limit to how much labour it can supply

- This explains why, in general, the countries with the highest population counts tend to produce the most GDP

- In general, more people = higher GDP

- Provides the upper limit to how much labour it can supply

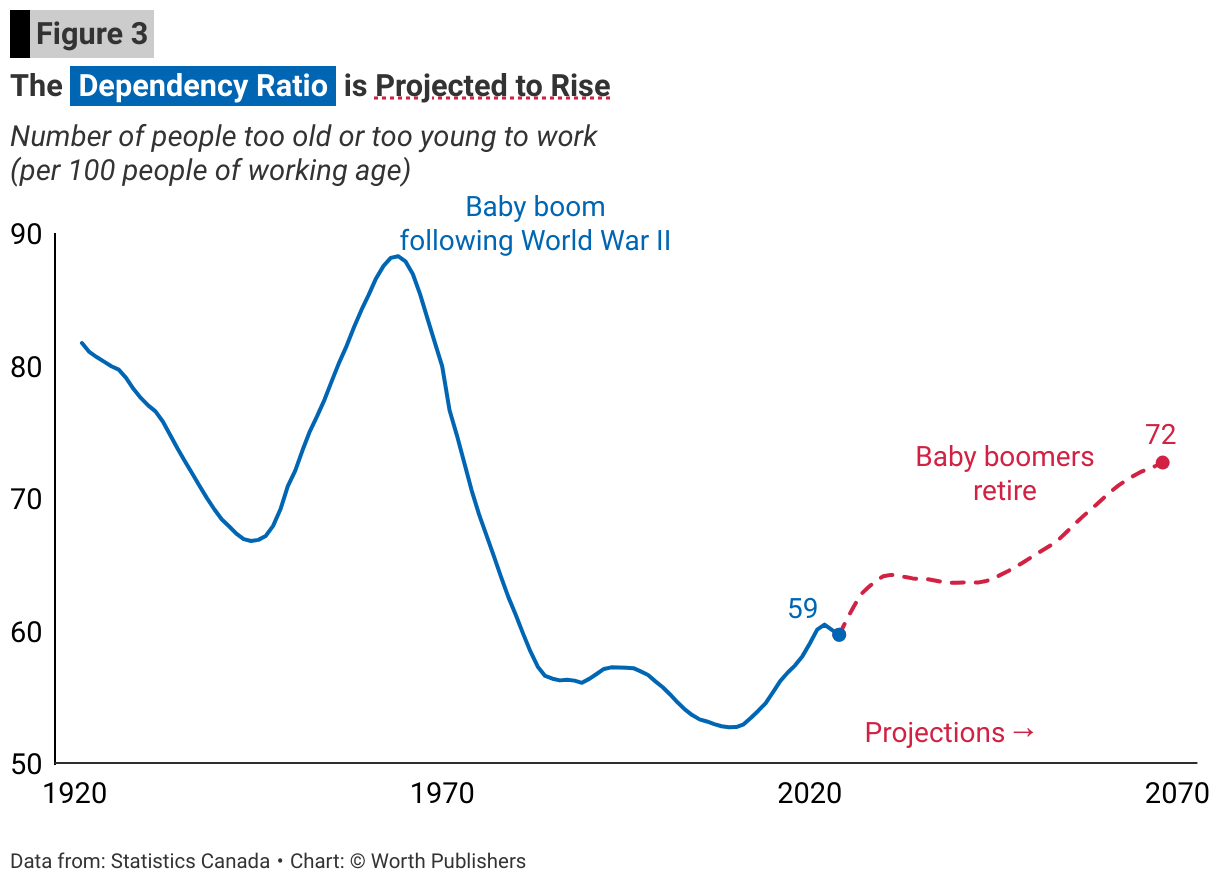

- the fraction who are of working age

- Children and elderly rarely work

- The dependency ratio measures the number of people either too young (under 18) or too old (65 or older) to work, per 100 people of working age

- In 2020, for every 100 people of working age, there were 58 people either too young or too old to work

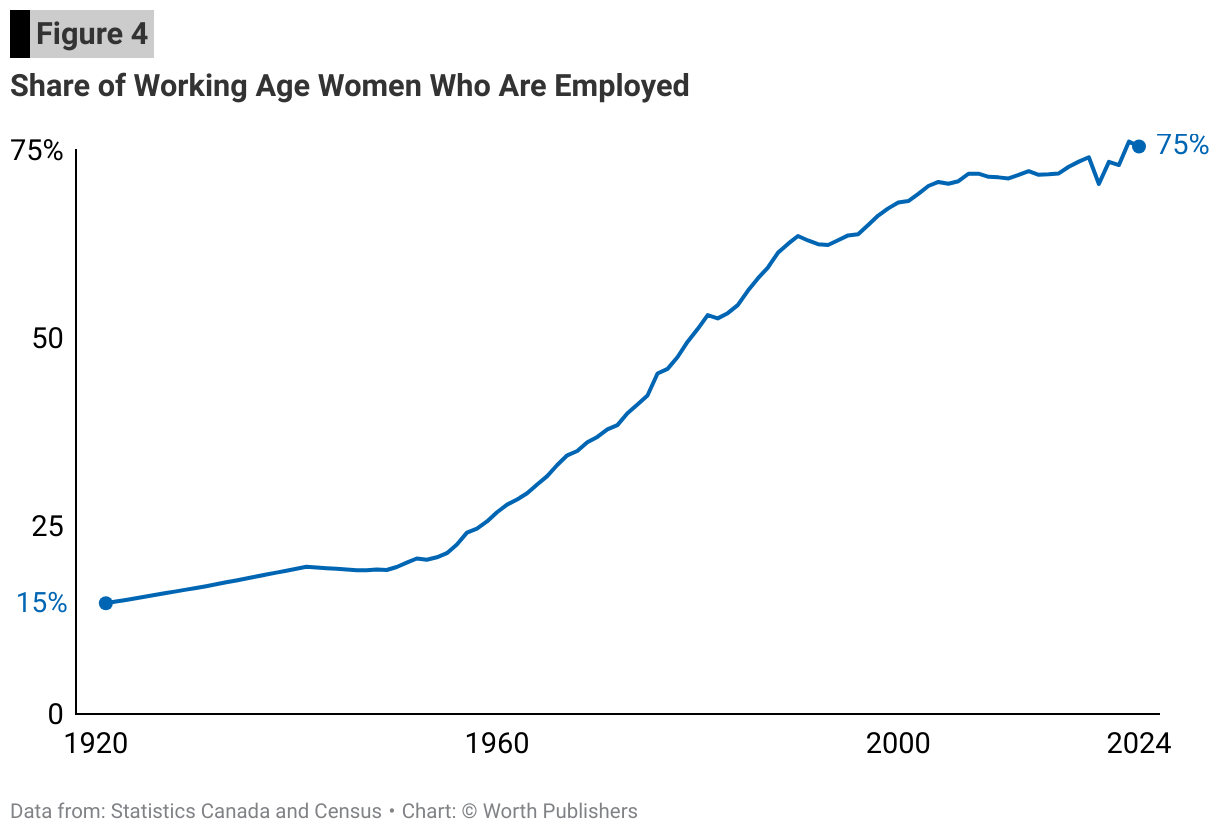

- the share of those working-age people who choose to work

- Over the past century, the main driver of the rising participation over the past century has been because of women's increased employment

- In the early 1900s, few woman worked outside the home. By 2019, that share had increased fivefold

- how many hours each worker puts in

- Shorter workweeks reduce GDP, but they might raise well-being

- The more hours people work, the more GDP they'll produce

- the size of the population

- Reflects four factors:

Ingredient Two - Human Capital

- Hours of work reflect quantity of labour used, but output is also reflected by the productivity of those workers

- The more each worker produces per hour, the higher GDP will be

- Labour productivity is output per hour of work

- Depends on human capital (the skills and knowledge developed through education, training, and practice)

- For example, as an undergrad student, the things I am increasing my human capital immensely

- This is a big reason why graduates are more productive and higher paid than someone not in university

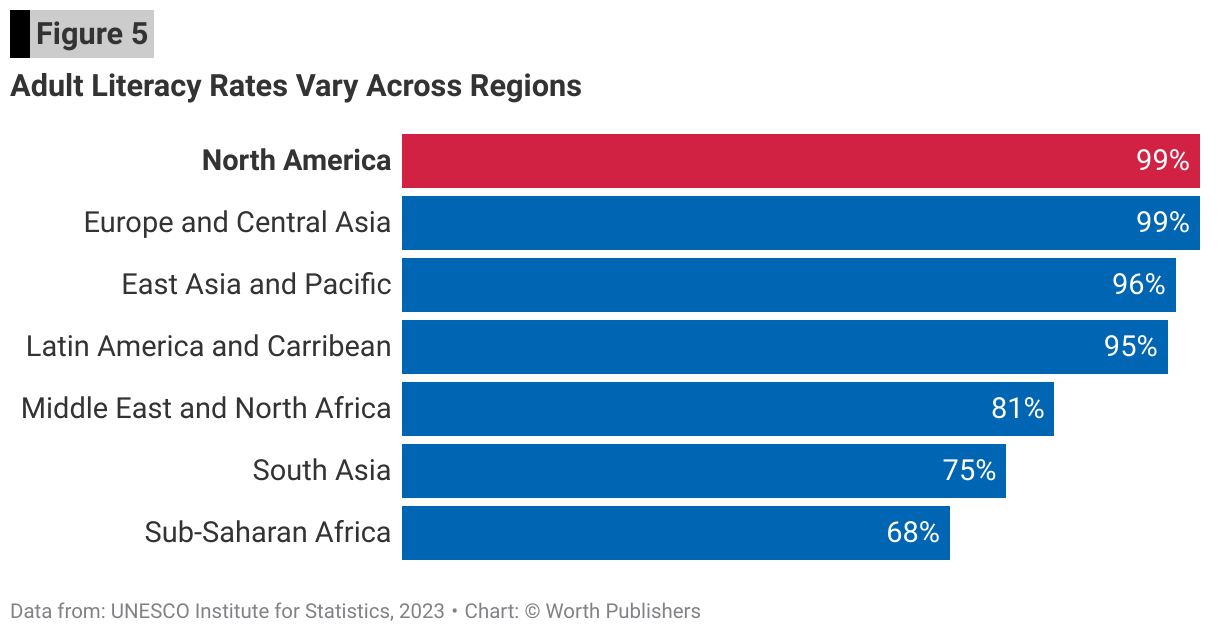

- Literacy is a foundation skills that gets overlooked. This is developed in primary education

- Secondary education promotes greater productivity in a range of jobs

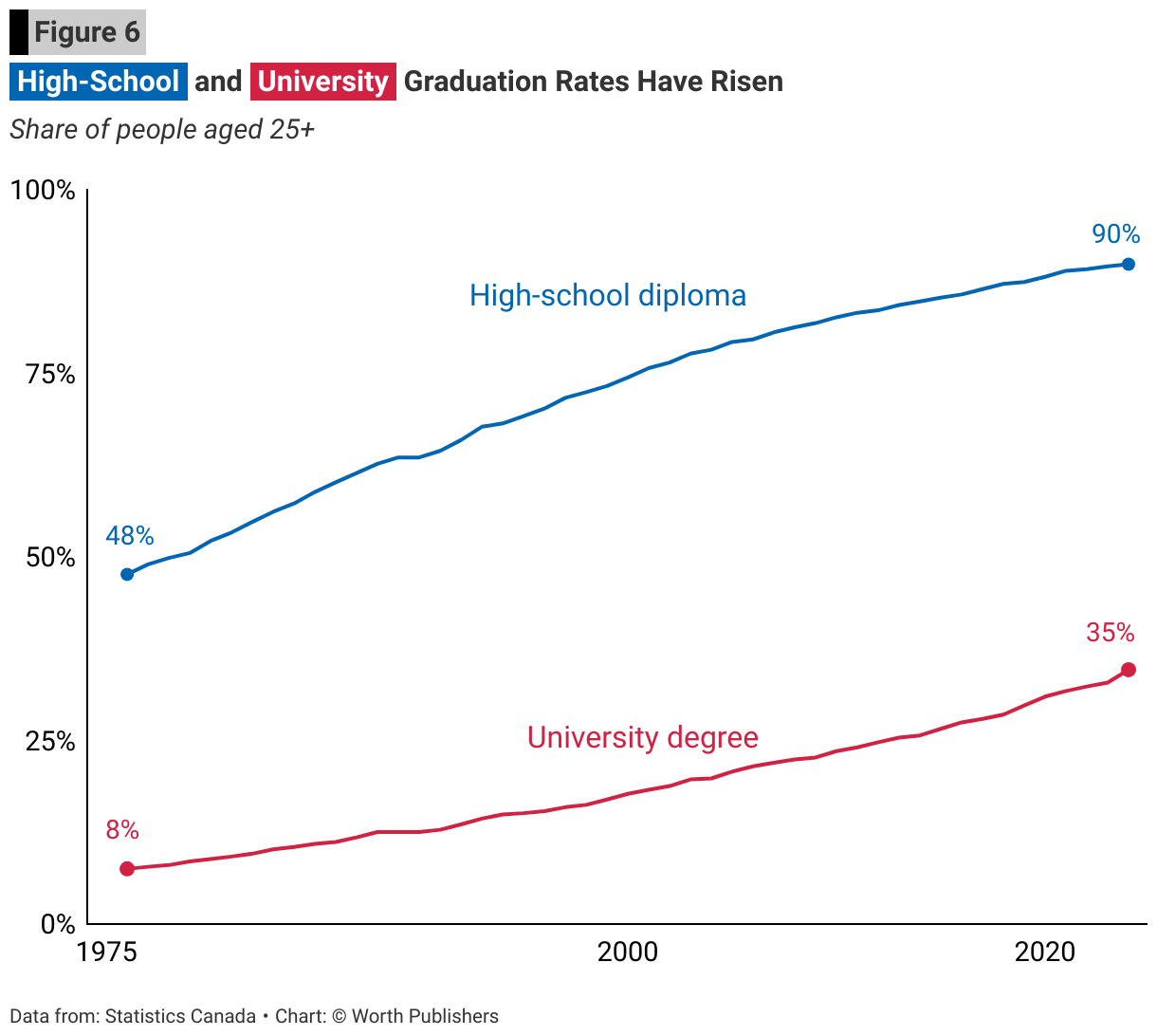

- Canada invested more in the education of its citizens compared to many countries, which stands as a big reason it was one of the fastest growing economies in the twentieth century

- Free secondary education proved all its haters wrong and enabled blue-collar workers to work with increasingly sophisticated machinery, boosting their productivity

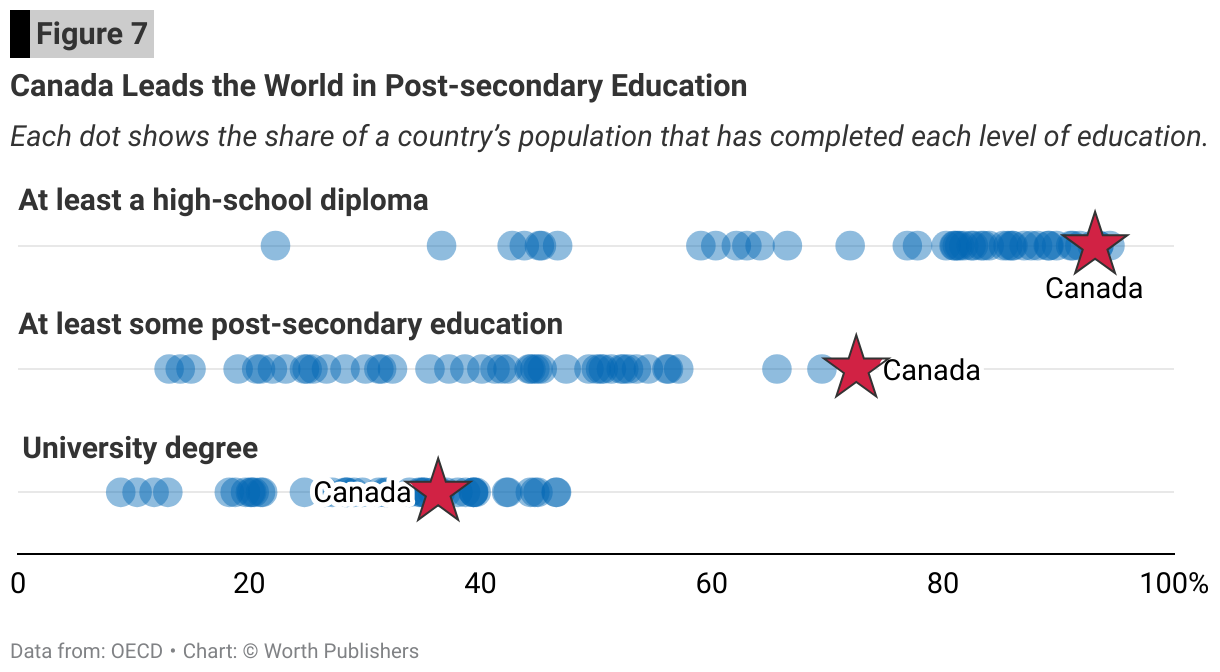

- Canada is the world leader in the share of the population with at least a two-year college certificate

- However, Canada lags behind other rich countries in the share of population with a university degree

- Lowering this discrepancy would increase our human capital

- Lowering this discrepancy would increase our human capital

- The rate of return to postsecondary education is estimated at around 10% higher earnings for each additional year

- Researchers often find that the return for economics students is higher than almost any other program

- Having a university degree, on average, leads to $1 million higher lifetime earnings

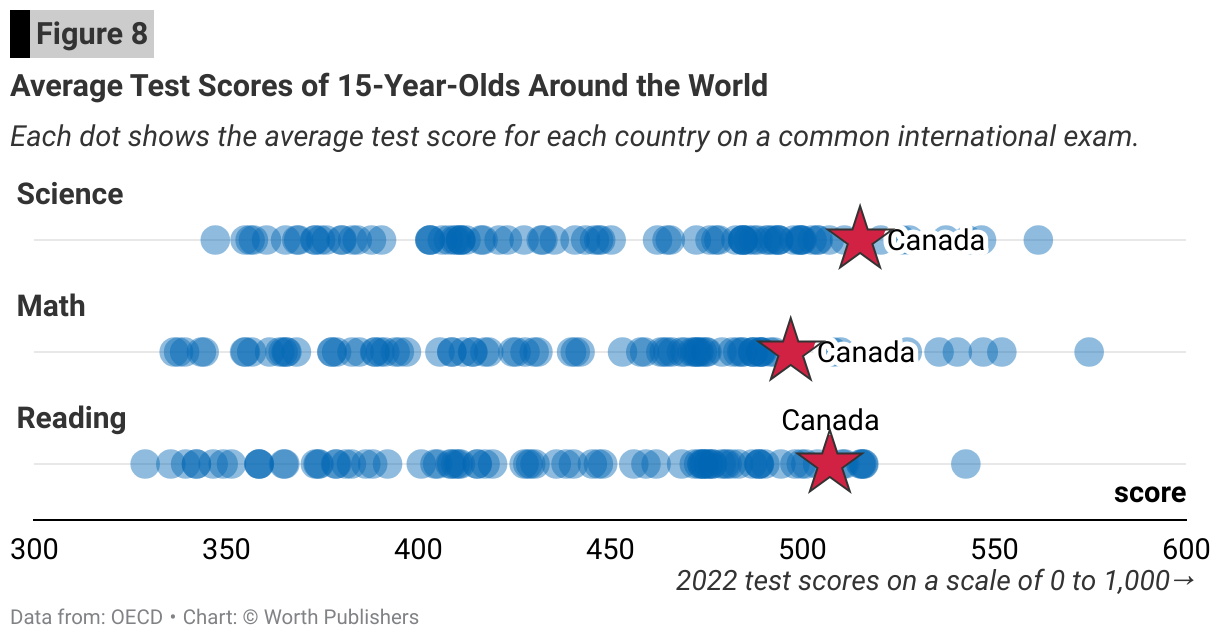

- Quality of human capital also matters

- When international exams are given across countries, Canada is actively among the leaders in quality

- When international exams are given across countries, Canada is actively among the leaders in quality

Ingredient Three - Capital Accumulation

- The equipment you work with matters!

- Example: a pastry chef working with commercial-grade mixers and large ovens will produce more than a baker at their house

- Capital stock is the total quantity of physical capital, and includes all equipment and structures used in the production of goods and services

- Includes both privately owned tools, machines, factories, and government-provided infrastructure such as roads, electricity networks, telecommunications

- Workers produce more when they have the right tools available to them

- Physical capital is a complement to labour

- Investment occurs out of resources that are saved rather than consumed and as a result, the savings rate is a critical determinant of investment. This ultimately determines the amount of capital each worker has to work with

- Foreign investment builds the capital stock

- For example, Japanese automaker Honda built a manufacturing plant in Alliston, Ontario in 1986 and has invested hundreds of millions of dollars into upgrades and expansions in the years since

- Even though the plant is Japanese-owned, it employs Canadian workers who work with that capital, and the cars rolling off the production line are made in Canada, and count toward Canada's GDP.

- For example, Japanese automaker Honda built a manufacturing plant in Alliston, Ontario in 1986 and has invested hundreds of millions of dollars into upgrades and expansions in the years since

New Recipes for Combining Ingredients: Technological Progress

- Technological progress - new methods for using existing resources

- These new methods create ways to produce more valuable output from your existing inputs

- Sometimes, technological process can involve new production techniques that build on scientific discoveries

- Example: The discovery of how to rotate crops to replenish the soil led to a massive boost in crop yields

- Sometimes, technological process is literally a new recipe - my example: ASML

- Sometimes, technological process can involve new production techniques that build on scientific discoveries

- Computers embody technological progress

- The key ingredient of computers is sand (silicone) and it's existed forever, but we typically used it for other recipes

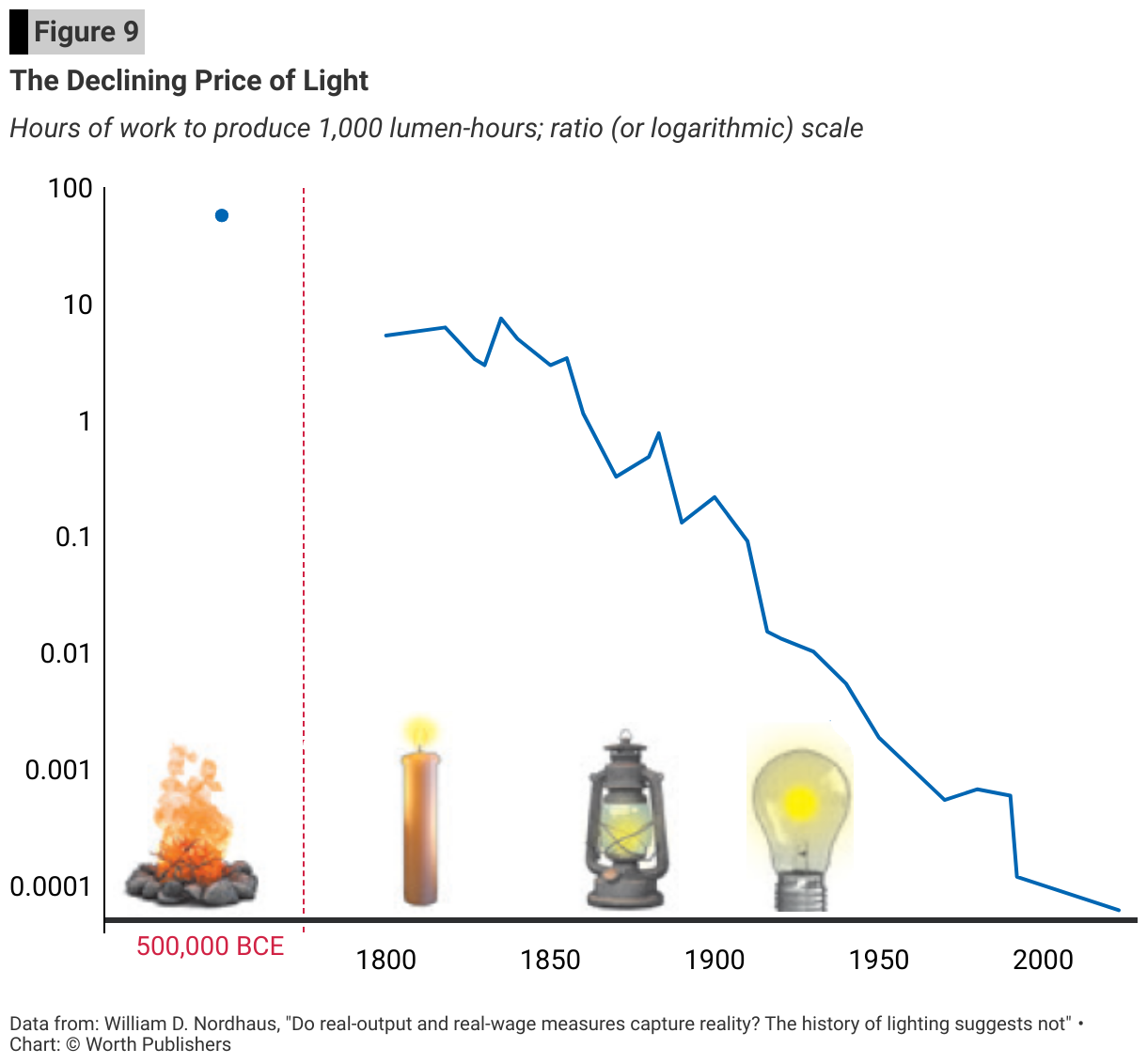

- The advancements of light - prices have dropped INSANELY

10.3 - The Analytics of Economic Growth

Analyzing the Production Function

- Constant returns to scale means doubling inputs will double output

- Replication argument: If you want to double the output of your factory, build a new factory (Capital accumulation), hire the same new people with the same skills (Human capital), and the same labour hours. In total, you'll be using twice the inputs to produce twice the output.

- Applying this argument to the whole economy, if the Canadian population (and thus workforce) grows, and the capital stock grows enough that capital per person stays the same, and investment in education also rises in proportion so that human capital per person is unchanged, then GDP per person will stay the same

- There are diminishing returns to capital

- What happens if you double your physical capital and don't change the number of workers? You'll produce more, but not twice as much

- Increasing only physical capital will produce a less than proportionate increase in output

- The law of diminishing returns says that when one input is constant, increases in the other inputs will, at some point, yield smaller and smaller increases in output

- With fixed capital stock, adding more workers will yield smaller boosts to production

- Poor countries can enjoy catch-up growth

- If a relatively poor country starts investing in machines, factories, and other equipment, it will experience relatively rapid output growth compared to richer countries

- This is the story of South Korea

- Over 30 years, its GDP grew by a factor of 12

Capital Accumulation and the Solow Model

- By analyzing the production function, investment, capital accumulation and economic growth is sometimes called the Solow model (named after American economist Robert Solow)

- The capital stock will grow as long as investment outpaces depreciation

- Investments in new equipment and structures boost the capital stock, and therefore the economy's capacity to product output

- However, machines break down, factories crumble, roads get potholes, etc. so each year some proportion of the existing capital stock is destroyed by depreciation

- So, capital stock will continue to accumulate as long as investment exceeds depreciation

- Capital per worker will eventually stop growing

- As capital stock grows, there are more machines (and thus more machines that are going to break), so total depreciation will grow

- Also, there are diminishing returns - each increment of capital creates a smaller and smaller increment to output

- This combination means that at some point, the amount of new investment the economy generates will no longer exceed the amount of capital lost to depreciation.

- When investment and depreciation are equal, the capital stock stops growing

- Capital accumulation can't sustain long-term economic growth

- Each successive cycle of increased capital yields successively smaller boosts in output, and so smaller boosts in investment

- However, on each successive cycle, the economy's depreciation bill keeps rising

- Eventually, the process stalls because the economy grows to the point where new investment in capital merely offsets depreciation

- This is called the steady state

- When the capital stock stops growing, then output will stop growing as well

- Each successive cycle of increased capital yields successively smaller boosts in output, and so smaller boosts in investment

Technological Progress

- The key to sustained economic growth is technological progress

- Technological progress shifts the production function upwards, increasing the output each person produces, for any given level of capital per person

- A burst of technological progress will spur a burst of new investment, and the economy grows towards a higher steady-state level of capital

- Technological progress relies on new ideas

- New technology is fundamentally about new ideas

- It is driven by: how quickly new ideas are created and how many resources are devoted to generating new ideas

- Workers can produce either goods or services or new ideas

- This creates a trade-off: either produce lots of goods and services and no ideas or produce more ideas and less goods

- New technology is fundamentally about new ideas

- The absence of technological progress explains why growth took so long to occur

- People were in battle-to-survive mode, so no spare resources existed

- Today, the opportunity cost of having people work on innovating is lower, so we do it more

- Technological progress allowed us to break the cycle of poverty

- For most of history, there was little technological progress and is why there was so much poverty and little economic growth

- If there are no limits to technological progress, there are no limits to economic growth

- Energy consumption is a topic of focus

- The more energy we use, the hotter we make the planet

- Canadians use more energy than the average person across the planet (in part because it's cold)

- As Canada's economy has grown, we haven't increased energy consumption that much

- Ideas can generate unlimited growth

- Idea-driven economic growth is different from physical capital by:

- Ideas can be freely shared

- My use of a new idea doesn't make it harder for somebody else to use that idea (this is referred to as nonrival)

- Ideas do not depreciate with use

- Doesn't wear out like a factory

- Ideas may promote other ideas

- Example: Apple's invention of the iPhone spurred app creators to create applications for smartphones.

- Ideas can be freely shared

- Idea-driven economic growth is different from physical capital by:

Everyday Economics

- Innovative companies make time for new ideas

- Since innovation sparks economic growth, that means it also sparks business growth

- Example: Google's founders Larry page and Sergey Brin ensured to have a "20% rule" where all employees must spend up to 20% of their workweek dreaming up and developing their own ideas for new products

- The issue with ideas is that they're nonexcludable (it's hard for you to prevent others from using - and profiting off - your idea)

10.4 Public Policy: Why Institutions Matter for Growth

- What factors determine whether people will invent new ideas and invest in human or physical capital?

- Incentives!

- The government provides the framework that creates the right incentives for people to come up with new ideas and bring them to marketplace

- Roads and networks allowing distribution as an example

Property Rights

- Property rights determine who controls a tangible or intangible resource

- This provides an incentive to work hard to be able to get a resource like money, land, or an ownership stake in a company

- To have well-define property rights requires having a clear set of laws that establish your rights, and a stable, trusted system of enforcing those rights

Government Stability

- Corruption and political instability can discourage investment and innovation

Efficiency of Regulation

- In Canada, a typical business is up and running in just a handful of days

- Government regulations provide some basic assurances for customers that they can trust the business

- Example: A restaurant following health and safety standards

- In Venezuela, in 2019, it took 230 days to open a business. Compared to Canada, you could have opened more than 100 businesses in that same time

- On average, it's harder to open a business in poorer countries than in rich countries

- Combined with red tape, there is many bureaucratic obstacles and government corruption

Government Policy to Encourage Innovation

- A trusted government, with clear property rights, a well-functioning legal framework, and regulations that effectively balance protecting the public with encouraging entrepreneurship, are all part of the institutional structure that economists have shown is crucial for economic success

- Government policy can create incentives and support the development of new ideas in two ways:

- The government can create property rights around ideas

- It can subsidize the creation of ideas

- Example: university